Corporate Boards in the United States: How Visionary Are They?

Each year our friends at the global executive search consulting firm Spencer Stuart publish the Spencer Stuart Board Index, a study that examines the state of corporate governance among S&P 500 companies in the U.S. The 2012 Spencer Stuart Board Index was published in late 2012 and offers insight into the state of corporate boards in the U.S.

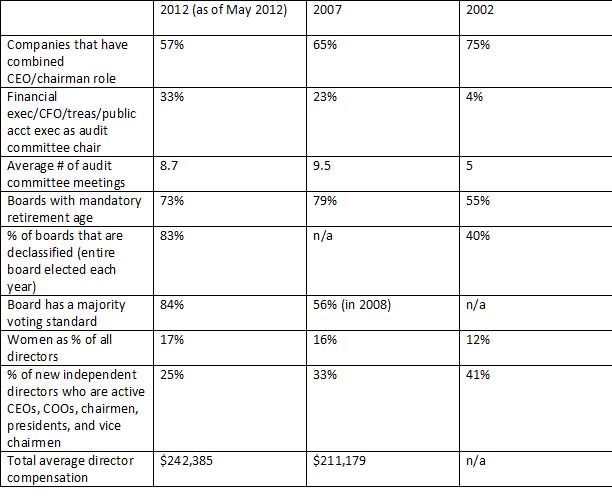

In the 2012 Spencer Stuart Board Index report we are given a peek at how board composition, policies, and practices stack up against the same practices in 2007 and 2002. And you know what? We’ve come a long way in some areas. Take a look at these stats:

What does this tell us? It tells us that fewer boards are run by a combined chair/CEO, thus lessening the risk of imperial CEOs. It tells us that audit committees have more financial expertise than a decade ago and are expected to do more work. We know that more boards have adopted mandatory retirement ages to keep boards fresher and that more and more directors have to stand for election each year and are subject to increased accountability by a majority voting standard. We see more women on boards than 10 years ago, although the pace of change is rather slow. And finally, we see companies reaching out beyond the C-suite for board members — hopefully bringing new talent and fresh ideas to the boardroom.

What does this tell us? It tells us that fewer boards are run by a combined chair/CEO, thus lessening the risk of imperial CEOs. It tells us that audit committees have more financial expertise than a decade ago and are expected to do more work. We know that more boards have adopted mandatory retirement ages to keep boards fresher and that more and more directors have to stand for election each year and are subject to increased accountability by a majority voting standard. We see more women on boards than 10 years ago, although the pace of change is rather slow. And finally, we see companies reaching out beyond the C-suite for board members — hopefully bringing new talent and fresh ideas to the boardroom.

In addition, we see that being a director in the U.S. is lucrative. But before you sign up for that director training course, you better understand the time commitment and expertise expected of you and the headaches you will deal with as a director. I recently saw a quote that summed up what it means to be a corporate director in this day and age: “Being a corporate director is a lot like being an airline pilot, years of training punctuated by a few intense moments of sheer terror.”

How Visionary Are Boards?

I also thought it might be instructive to line up the Spencer Stuart report against the Visionary Boards report we published in 2012 to see whether the practices our Visionary Board panel recommended play out in the real world.

As a refresher, here are the areas where we asked boards to provide leadership in order to help build successful companies over the long term:

- Quarterly Earnings Practices: A Visionary Board expects management to deliver investor guidance with a longer-term bias and in greater detail by identifying long-term value drivers for the company.

- Shareowner Communication: A Visionary Board proactively listens to the concerns of its shareowners and consistently communicates on long-term vision and strategy.

- Strategic Direction: A Visionary Board actively oversees and understands strategy and regularly monitors — with management — the implementation and effectiveness of strategic plans.

- Risk Oversight: A Visionary Board embraces risk as a board-level responsibility. It oversees robust processes for identifying, managing, and when necessary, mitigating risks to the operations, strategy, assets, and reputation of the company.

- Executive/Director Compensation: A Visionary Board ensures that the underlying objectives consistently support the long-term strategy and performance of the company.

- Board and Corporate Culture: A Visionary Board recognizes that strong corporate and board cultures are essential to the sustainability of a company’s long-term value.

Now let’s look at some of the stats from the Spencer Stuart report in these areas:

- Quarterly Earnings Practices: Not addressed in the report.

We’re not surprised to see this because it’s a very specific ask of boards, and not usually addressed in such board surveys

- Shareowner Communication: When asked who had primary responsibility to facilitate communication between the board and investors, 58% said either the chairman or lead director, 23% said the CEO (if CEO is not chairman), and 19% said “other.” Sixty percent of survey respondents said management or the board reached out to the company’s large institutional investors and shareowners.

We would like to see a breakdown of how active boards are in carrying out such communication and would advocate them becoming more active in this area.

- Strategic Direction: When asked for governance topics requiring the most focus from boards (more than one answer allowed), 67% pointed to the board’s role in corporate strategy decisions — a vast increase from the 31% who answered the same in 2008. Only 4% of companies have a dedicated strategy and planning committee.

It is good to see more boards taking ownership of a company’s strategic direction, and we believe this is the job of the entire board, not just a committee of the board.

- Risk Oversight: When asked to choose from a wish list of new director expertise, 23% of those surveyed cited expertise in risk. Only 8% of companies had a dedicated risk committee. Sixty-three percent of boards say that the full board has primary responsibility for risk oversight.

In light of the financial crisis in which so much risk was overlooked, it is heartening to see more boards taking responsibility for risk oversight; as with strategy we believe risk is the job of the entire board, not just a committee of the board.

- Executive/Director Compensation: When asked for governance topics requiring the most focus from boards (more than one answer allowed), 72% pointed to the board’s role in determining executive compensation — compared to only 52% who said the same in 2008.

We would have liked to see more information on compensation disclosures and responsibilities for communications concerning compensation issues, but it appears that boards are keenly aware of the importance investors place on compensation issues.

- Board and Corporate Culture: Not addressed by the report.

It is no surprise that the survey didn’t delve into culture issues, but we would like to see this or other surveys take on the issue of culture in the future. A poor corporate or board culture can have disastrous implications for a company and its investors.

Finally, I also found a few nuggets of information that are potentially troubling.

According to the Spencer Stuart report, about 42% of the time the current CEO interviews board candidates. Now this isn’t necessarily evil. The CEO may be just one of many people interviewing a prospective board member. A problem arises when the CEO is the main voice in picking board members, therefore giving that person the ability to appoint a facile board that will not offer constructive criticism or an independent voice. More data is needed here.

There is one piece of data I did find unequivocally bad. According to the Spencer Stuart survey, about 31% of the time the CEO determines committee membership at S&P 500 companies. That means that at about one-third of S&P 500 companies, the CEO is the main voice in determining either audit committee membership, compensation committee membership, or nominating committee membership. This can’t be good. The fox is deciding who watches the audit, compensation, or nominating henhouse. Am I reading this wrong? Unfortunately, I don’t think so.

Corporate governance in the U.S. has come a long way in the past 10 years. We still have further to go.